The Blockchain and ESG debate cannot simply end on the ‘E’ part of the acronym

By Antoni (Antek) Hasiura ‘24

One of the most common arguments used against cryptocurrency and blockchain are environmental concerns. That’s not surprising, as more people than ever, particularly among Gen Z, begin to see combating climate change as the most important political challenge of our time. While this shift has been happening among both individual and institutional investors, blockchain developed a bad reputation for the carbon emissions it creates. When one hears the famous statement that “Bitcoin uses more electricity than some countries”, it’s easy to jump to the conclusion that such an asset could not possibly have a space in a wallet of an ESG-aware investor. Environmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments and many believe that blockchain is strongly misaligned with these goals. However, this issue is much more nuanced than many of the blockchain skeptics showcase it to be.

The debate most commonly focuses on a single blockchain (Bitcoin) and on a single issue (the Environment) and overlooks the Social and Governance benefits that blockchain can bring to millions of people, as we will explore later. Even the environmental debate itself presents blockchain in an excessively negative light, as I’ll explain in just a bit. I strongly believe that crypto has a space in the wallet of an ESG-aware investor. Let me explain why.

Key Argument Against Blockchain: The ‘E’ (Environment)

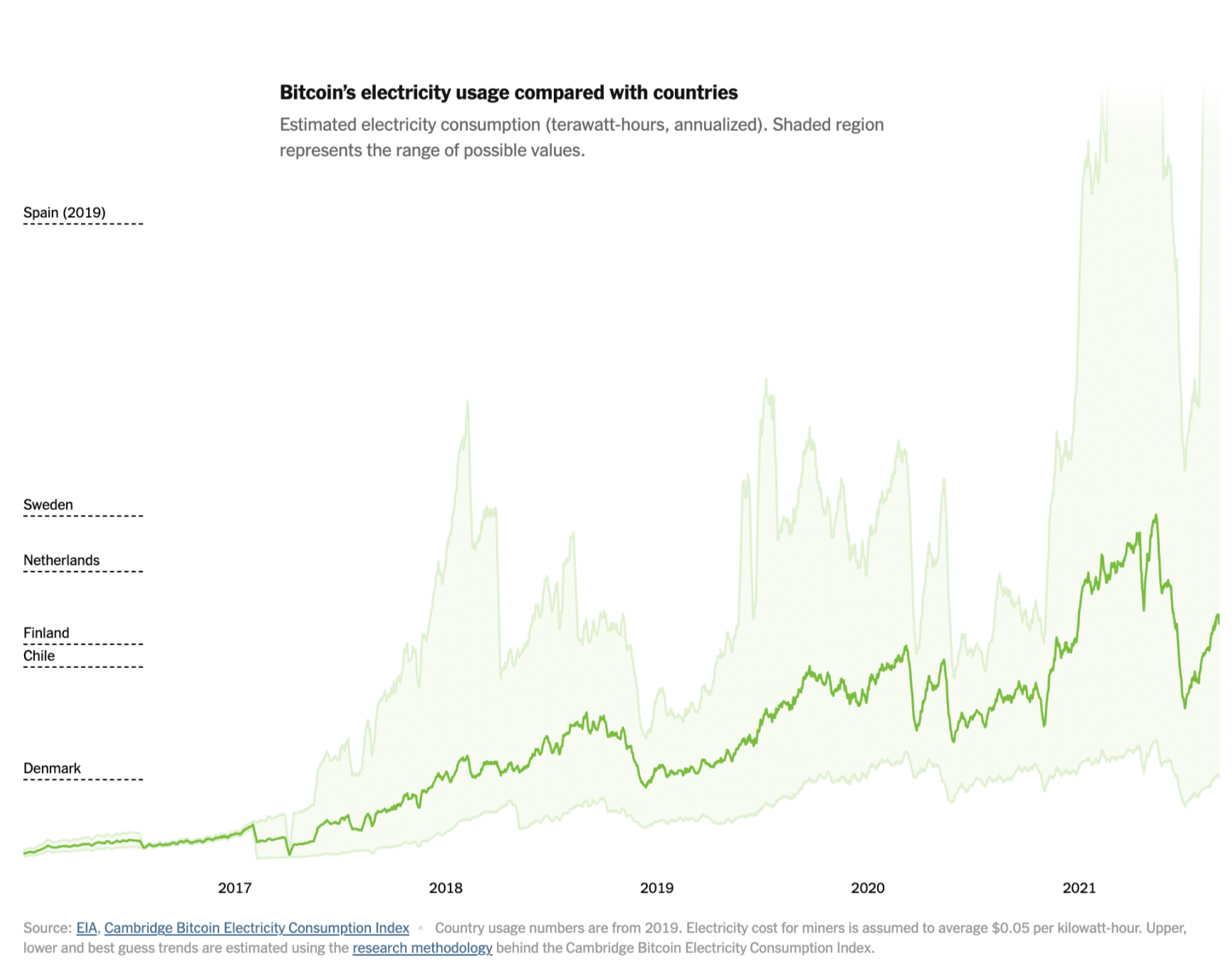

Let’s first discuss the key argument of the Crypto and ESG debate: the environment. It’s important to acknowledge that environmental concerns surrounding proof of work blockchains have a degree of credence. They do, indeed, use astonishing amounts of energy. The process of mining a Bitcoin consumes around 91 terawatt-hours of electricity annually. That’s more than is used by Finland, a nation of about 5.5 million. The following chart compares the Bitcoin electricity usage versus that of some countries.

Adapted from the New York Times

Bitcoin’s appetite for energy has also been growing exponentially in recent years. While in 2009 you could mine a Bitcoin with a simple PC setup in your living room, in May 2021 you’d need at least 13 years of typical household worth of energy consumption to do the same. Proof of work, on which Bitcoin is based, creates an incentive for miners to simply keep increasing their computing power, which creates a potential environmental threat due to the carbon emissions such actions generate. However, as I mentioned earlier, this issue of electricity used for mining is much more complicated than it may first seem.

The Environmental Debate is much more complex

First of all, it’s important to note that blockchain has an incredible capacity to use energy that many of the other industries can’t. Almost all energy worldwide must be produced relatively close to its end users, but Bitcoin has no such limitation and can be mined practically anywhere. This enables miners to utilize power sources that are inaccessible for most other applications and make use of the stranded generation of energy that would otherwise be wasted. Hydro energy is the most well-known example of that. In the wet season in Sichuan and Yunnan, China, enormous quantities of renewable hydro energy are wasted every year. In these areas, production capacity outpaces local demand, and battery technology is far from advanced enough to make it worthwhile to store and transport energy. Before China’s ban on crypto mining, this great example of a stranded resource was responsible for almost 10% of global Bitcoin mining in the dry season and 50% in the wet season. There are many other places like that on Earth.

Bitcoin has one of the highest proportions of renewable energy among all industries. Many mining companies are also shifting to renewable energy sources with investor pressure. Globally, estimates of Bitcoin’s use of renewables range from about 40 percent to almost 75 percent. Compare it to the US overall energy consumption and we can see the relative drastic difference in how ahead the industry is in terms of using renewable resources:

The sustainability of crypto mining depends strongly on where the mining process physically happens. With China’s ban on crypto mining, there is a growing opportunity for a shift to countries with a more sustainable capacity for mining. A recent paper published by the Multidisciplinary Digital Publishing Institute in the Energies journal identified key characteristics that make a geographic location more sustainable for crypto mining (such as the country’s share of electricity production from renewable sources, average temperature, etc.). The researchers ranked 144 countries according to the mining sustainability index they developed.

The trend showed that crypto mining is relatively more environmentally friendly in countries in North America (the USA and Canada), Western & Central Europe, and Australia. Asia, South America, and Africa showed to be substantially less sustainable. Why does this matter? Because China's ban on crypto mining has already completely shifted the geographical spread of hashrate among countries. It caused a complete relocation of the industry which used to hold 75.5% of the global hashrate share.

Adapted from the Visual Capitalist

This is a great chance for crypto to improve mining sustainability. China ranked as 40th in the mining sustainability ranking, while countries like the US, Canada, and Germany, which now constitute a substantial share of the hash rate, rank significantly better.

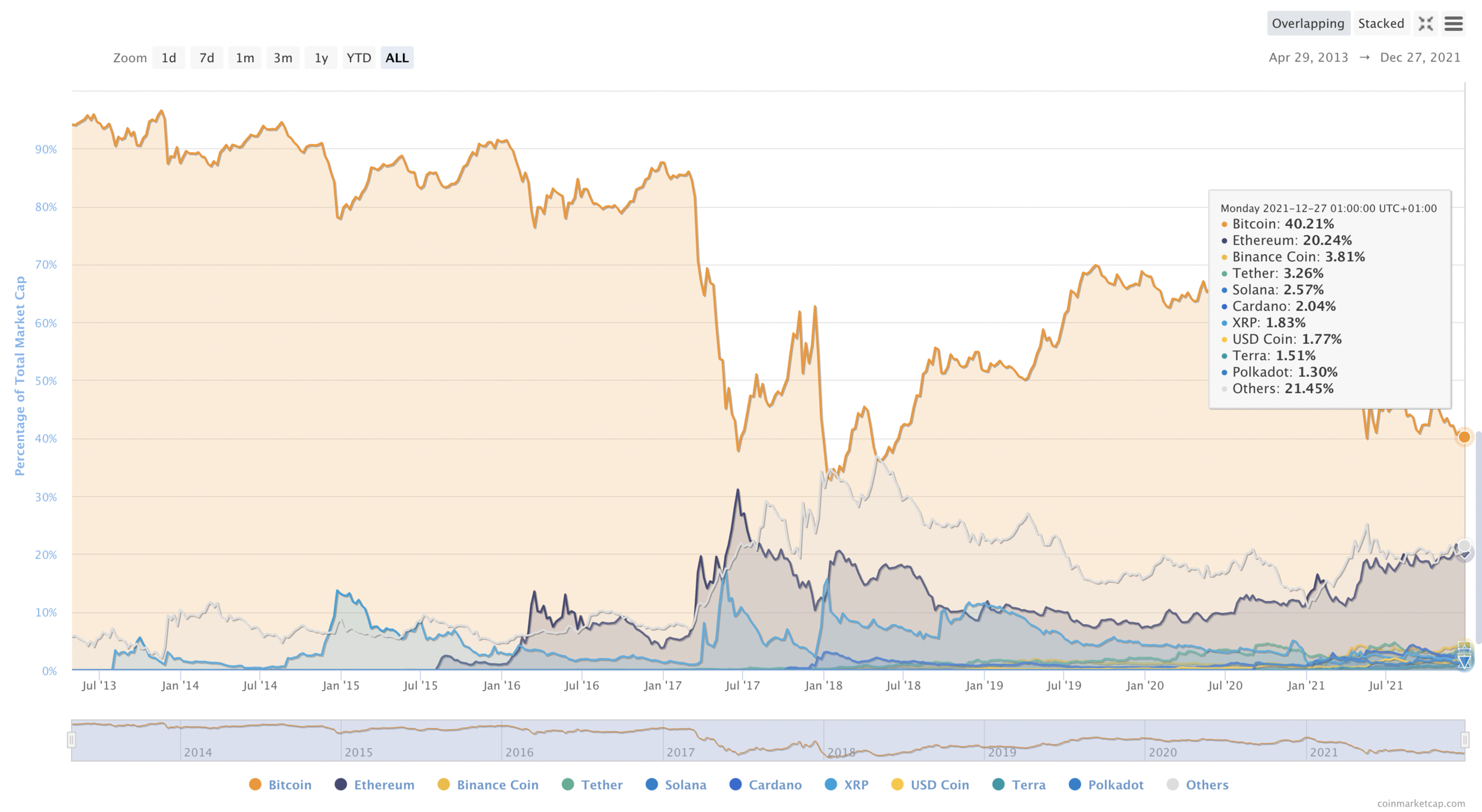

Lastly, let’s not forget that blockchain and crypto are much more than simply Bitcoin. The energy intensity of other blockchains is already actively declining and alternatives to proof of work are gaining in popularity. Proof of stake, the most common new consensus mechanism, will soon replace the proof of work in Ethereum, the second most common crypto asset right now. The shift which will occur with the introduction of proof of stake-based Ethereum 2.0 in 2022, will cut its power consumption by around 99.5%. Keep in mind that the investors’ sentiment already made ETH the second biggest coin by market cap, which constitutes over 20% of the global crypto market cap.

Once Ethereum makes the transition to 2.0, around 57% of the blockchain market cap will not be energy-intensive.

At this point, blockchain opponents still argue that even though the energy use might not be as bad as it seems, we are still “wasting” precious energy that could be used to power households or charge electric cars instead. Why do we need blockchain in the first place when we can just have all this energy utilized for still more sustainable causes? The ‘E’ of ESG is important but the conversation cannot just end there. That’s where the ‘S’ and ‘G’ benefits come in.

The ‘S’ (Social) and ‘G’ (Governance) benefits are where blockchain truly shines

Blockchain is an incredibly powerful tool to achieve social objectives. The very mission of the decentralization of finance is to give users financial autonomy and grant access to banking to those who were traditionally restricted from it. It presents a tremendous opportunity to accelerate fintech development in emerging markets. Think, for example, of Latin America. American Market Intelligence estimates that only about 45% of Mexicans, 52% of Peruvians, and 60% of Argentinians, currently have a bank account. Many of the people in these countries do not trust the governments in the ability to safely store their savings or to maintain a stable exchange rate of their fiat currencies. Blockchain presents a tremendous opportunity in this market. One that would allow millions of unbanked people to finally gain access to a safer, decentralized medium of exchange and store of value. Many blockchain startups in the region have already shown the great potential of the use of crypto in the region. A great example of this is a Venezuelan company Valiu. The software developed by the firm offered migrants access to dollar savings and to a transfer system to send money across borders to family members in spite of the country’s hyperinflation crisis. I wrote a more in-depth article on the blockchain prospects in Latin America earlier this year if you’d like to learn more about this topic.

On the social side, blockchain is permissionless in its essence and grants equal opportunity to everyone who owns a smartphone, regardless of their socioeconomic status. Smart contracts don’t exclude people who can’t get approved for a credit card in the traditional banking system. With the interest that people on all income levels can earn for staking, nations could help to mitigate the income inequality challenges. We can never do that with the current system, where the safe banking deposits that people on the lower income levels utilize usually pay close to 0.5% annually, while the wealthy have access to things like venture capital, which can frequently grow their assets at astonishing rates.

Blockchain completely changes the view of governance, likely in a positive way. There is practically no governance. That’s the essence of decentralized finance, where a number of miners all participate in the network. The code is open source and every Bitcoin transaction that has ever happened is published every ten minutes to anyone who wants to view it. Developments in the blockchain space accelerate other ones and they remain focused on decentralization and transparency. Furthermore, as blockchain has no borders, anyone can participate and we achieve practically ideal diversity and inclusion.

Bottom line: blockchain presents ESG challenges, but the ‘S’ and ‘G’ benefits significantly outweigh the rapidly decreasing ‘E’ costs. Crypto presents an incredible opportunity to benefit emerging markets and create a financial system that gives everyone access to assets safe from constant devaluations, no matter their national origin or socioeconomic status. Smart contracts will allow us to design a more efficient financial system, while developments powered by them, such as NFTs, can support artists and content creators around the globe, among many others. At the same time, the environmental costs, already not as drastic as some perceive them to be, are expected to rapidly decline as the blockchain space continues to innovate with things like more energy-efficient proof of stake.

Disclaimer: This article references personal opinions and should be used for informational and educational purposes only. It should not be utilized as investment advice. The Insights blog entries refer to opinions of individual club members and not to a stance of Princeton Impact Capital as an organization.