Can cryptocurrency be aligned with environmental goals?

By Brandon Cheng ‘25

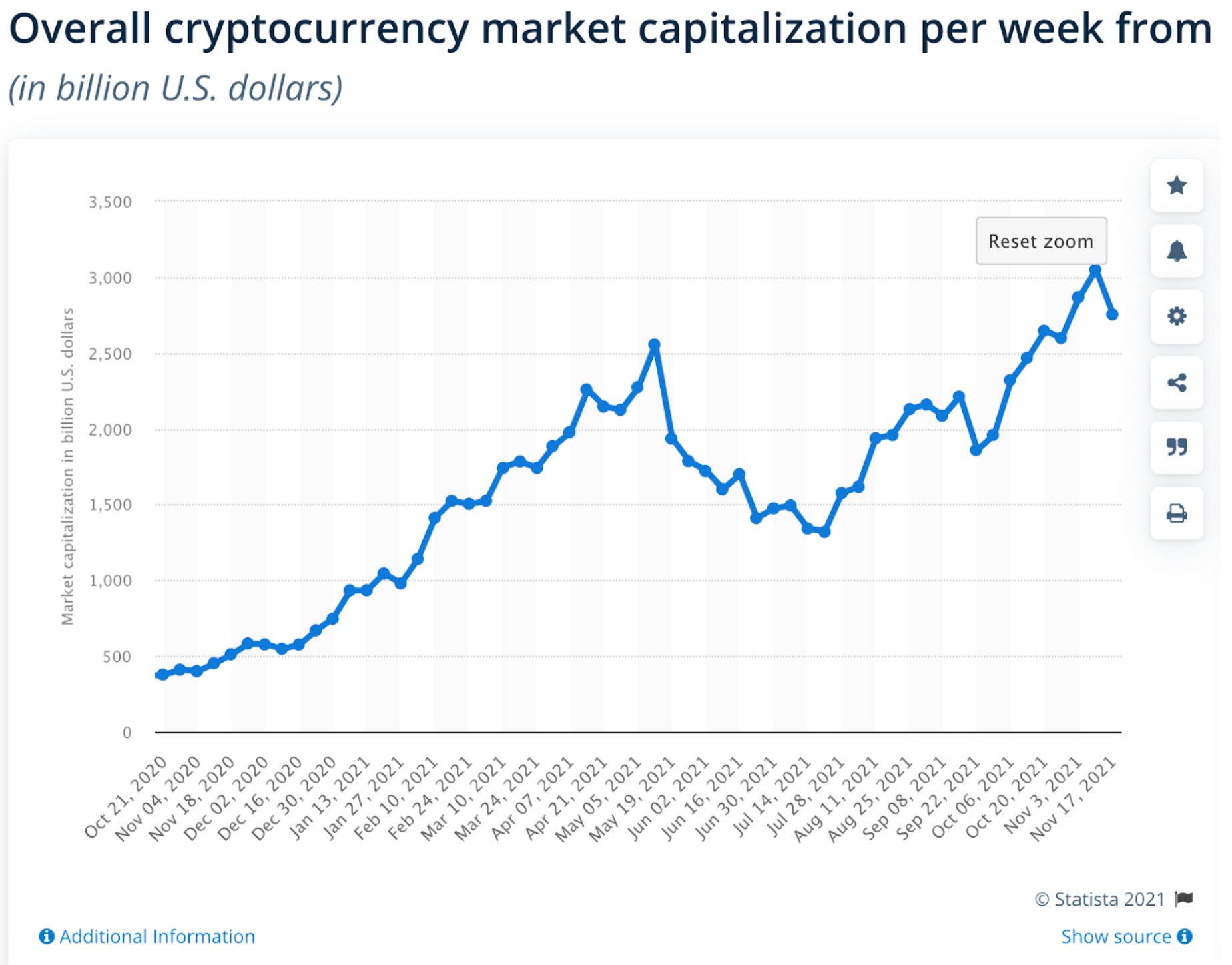

Cryptocurrencies are the newest and brightest investments in today’s financial landscape. According to figures from Statista, the total market cap of all cryptocurrencies increased 6x, from about 548 billion in December of 2020 to 3 trillion today. The broad diversity, function, and specifications of cryptocurrencies ensures there is something for all investors. Stable coins, such as USDC and Tether, are backed and linked to a central currency, thereby reducing volatility and offering an attractive option for risk-averse investors. On the other end of the spectrum, speculative meme cryptos such as Dogecoin experience dramatic growth and decline within a single day, allowing swing traders to profit and explore. There are also the big players in the market, Bitcoin and Ethereum, which have the most adoption thus far.

It’s no surprise that investing in cryptocurrency has become an accepted and even encouraged way of generating positive returns, and crypto companies are taking advantage of this wave. Recently, Singapore crypto trading platform Crypto.com splashed $700 million on a deal for the renaming rights to the iconic Staples Arena, and increasingly, countries such as El Salvador are adopting cryptocurrencies as legal tender.

What is lost in this frenzy, however, are the damaging environmental effects of cryptocurrency mining, which consumes an enormous amount of energy. According to a recent BBC report, Bitcoin consumes about 121 Terra-watt hours of electricity per year, exceeding that of Argentina! Producing this electricity at a reasonable cost often requires the burning of coal or usage of other fossil fuels. Indeed, crypto mining is reported to have released almost 36 million tons of carbon dioxide emissions annually, as much as the country of New Zealand!

For investors mindful of sustainability, supporting something that damages the environment as much as some nations is too much. Is it possible to reconcile ESG principles with crypto?

The answer is complicated. There’s no debate that cryptocurrencies are not energy efficient, but their rapid growth shows no signs of slowing or stopping. Marie Freier, the Barclays Head of ESG Research, suggested (at a recent PIC speaker series) that impact investing is not about ignoring environmentally flawed companies, but rather investing in ideas, technology, and people that might be able to transform them into something more positive. Applying that same idea, I highlight some crypto investments that show promise.

Firstly, there are certainly more energy efficient cryptos that employ different mining mechanisms to reduce energy consumption. One excellent example is Cardano, the 5th-largest coin. Its innovative proof-of-stake concept, in which users purchase a stake (tokens) of Cardano before joining the network, dramatically decreases energy use, so that Cardano consumes about 0.5 kWh per transaction. Compared with Bitcoin’s 707 kWh a transaction, Cardano is far more environmentally friendly.

Some coins are created for the purpose of incentivizing environmentally-focused goals. SolarCoin, for instance, is distributed to users as a reward for installing solar panels. The clever design of SolarCoin ensures that when the value of SolarCoin exceeds energy production cost, the installation is essentially free. Thus, SolarCoin encourages more people to acquire the coin, so as to drive demand and price upward. Simultaneously, solar tech installers are encouraged to continue reducing energy costs, either by making solar panels more efficient or by installing a greater network of panels. In this way, SolarCoin encourages active participation in changing the environment, and investing in this innovative approach to energy sector transformation has remarkable potential.

Cryptocurrencies are here to stay. While business practices around crypto are certainly not environmentally beneficial right now, investing in companies and technology that seeks to transform crypto can allow interested investors mindful of ESG principles to invest with impact.